Australia Problem Gambling Statistics

Total recorded losses through gambling in Australia reached just over $19 billion in 2008–09 (an average of $1,500 per gambler and a share of household consumption of 3.1 per cent).

Total gambling expenditure in Australia decreased from $23.804 billion in 2015–2016 to $23.694 billion in 2016-17 (a 0.5 per cent decrease) per adult gambling expenditure in Australia decreased from $1,277.83 to $1,251.39 (a 1.7 per cent decrease). For example, if Statistics On Problem Gambling In Australia you deposit €100 and receive a €500 bonus, then you have to wager €600. 40 = €24 000 before you can make a withdraw. Add a maximum withdraw limit to this and Statistics On Problem Gambling In Australia your chances to win big are severely decreased.

Executive Summary

This report provides an overview of gambling activity in Australia in 2015, with respect to participation, expenditure, and problems among regular gamblers. The report follows a format and style common to gambling prevalence studies conducted in Australia and elsewhere.

As with those studies, the report is intended as a reference document. It is written primarily for researchers and government officials who have an interest in Australian gambling statistics. This report makes a unique contribution to knowledge of gambling in Australia, since Australia has no prior history of surveying and reporting on gambling activity among regular gamblers at the national level.

The content consists primarily of descriptive statistics with a focus on population estimates. The statistics were obtained from cross-sectional analysis of Household, Income and Labour Dynamics in Australia (HILDA) Survey data, wave 15, which is the first wave to include gambling questions. The HILDA Survey was designed so that participants' responses (17,606 participants in wave 15) could be generalised to the Australian adult population.

The participation statistics include population-representative estimates of the proportion and number of Australians who spent money on up to ten common gambling activities (lotteries, instant scratch tickets, electronic gaming machines, race betting, sports betting, keno, casino table games, bingo, private betting and poker) in a typical month of 2015. The report refers almost entirely to these gamblers, which we refer to as regular gamblers.

Chapter 1 of this report provides the background to the study and details regarding study design and methodology. Chapters 2 and 3 respectively provide statistics regarding typical gambling participation and expenditure.Chapters 4 and 5 address participation and expenditure among adults who experienced gambling-related problems. In Chapter 6 gambling expenditure is positioned within the household budgets of low, middle and high-income households. As well, rates of financial stress are compared between households that contain members with and without gambling problems. Additional tables, including a comparison of the HILDA Survey gambling statistics with recent state/territory and national prevalence data and industry revenue data, can be found in the Appendices.

The report identifies an estimated 6.8 million regular gamblers in 2015, among whom lottery participation was very common (76%). Instant scratch tickets (22%) and electronic gaming machines (EGMs; 21%) followed, attracting 1.4 to 1.5 million gamblers. Less than a million gambled regularly on anything else, including racing (14%), sports betting (8%), keno (8%), casino table games (3%), bingo (3%), private betting (2%) and poker (2%). It was common for people to participate either solely in lotteries (59%), or a combination of lotteries and up to two additional activities.

While lotteries and instant scratch tickets were the most popular activities, individual gamblers spent comparatively little on these activities in a typical month, and therefore over the entirety of the year ($695 and $248 per year on average). Those who gambled on Electronic Gaming Machines spent a great deal more per year ($1,292 on average). So too did those who regularly gambled on races ($1,308), sports ($1,032), casino table games ($1,369), and particularly poker ($1,758).

Regular gamblers, viewed by activity, have quite different profiles. For example, compared to the Australian population:

- lottery participants were over-represented among older couples living without children;

- EGM participants were over-represented among people for whom welfare payments formed their main source of income;

- bingo participants were over-represented among retired women living alone;

- regular race or sports bettors were over-represented among men on higher incomes, yet the race bettors were more likely to be older and live in outer regional/remote areas; and

- sports bettors were more likely to be younger and live in an inner-regional area or major city.

Gambling problems are indicated in the HILDA Survey by endorsing one or more items on the Problem Gambling Severity Index (PGSI). According to the standard use of the PGSI, 1.1 million regular gamblers were estimated to have behaved in ways that caused or put them at risk of gambling-related problems.

Among this subset of regular gamblers, there were more sociodemographic similarities than differences. Those who experienced problems were generally more likely to be young, single, unemployed or not employed (excluding retirees and full-time students), Indigenous, men, living in rental accommodation, in a low socioeconomic area, and were more likely to draw their income from welfare payments than those who had no problems.

Those with problems were also more likely to participate regularly in certain activities. This led to rates of problems being particularly high among participants in six activities (EGMs, race betting, sports betting, casino table games, private betting, and poker) with almost 1-in-2 gamblers on any of these activities experiencing one or more issues.

Another thing those with problems had in common was higher than average spending on gambling. This was particularly so among EGM, race and sports betting participants. Those experiencing the greatest problems spent more than four times as much on these activities, and on gambling overall, as those without problems. Well over half of all expenditure by regular gamblers on these activities came from people who had problems.

Overall, more than forty percent of gambling expenditure by regular gamblers, aggregated across all activities, was accounted for by the 17% who experienced problems.

Gambling expenditure has significant financial ramifications for low-income households, particularly among households where gamblers experienced problems. Gamblers living in low-income households spent a much greater proportion of their household's total disposable income on gambling than high-income households (10% vs 1% on average) - this despite spending less in actual dollar terms ($1,662 vs $2,387).

Gamblers who had problems spent much more of their households' income on gambling than other regular gamblers, with those experiencing severe problems in low-income households spending an average 27% of their disposable household income on gambling - equivalent to four times their yearly household utility bills, or more than half the grocery bills for that income group.

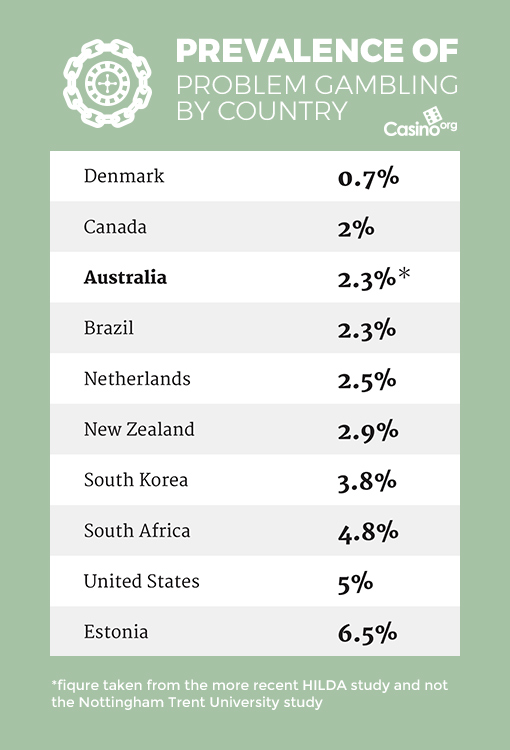

Australia Problem Gambling Statistics Worldwide

Consistent with these patterns of expenditure, the households of those with gambling problems had a much greater proportion of stressful financial events. Inability to pay electricity, gas or telephone bills on time, and needing to ask friends or family for financial help, were common occurrences.

Future waves of the HILDA Survey will provide nationally representative longitudinal data with which to measure changes in gambling activity and effects on individuals and their households.

The authors would like to thank all those colleagues who contributed to creating gambling questions for the HILDA survey and for their input into this report. In particular, we would like to thank:

- Doctor Anna Thomas, Australian Gambling Research Centre, Australian Institute of Family Studies

- Doctor Jennifer Baxter, Australian Institute of Family Studies

- Assistant Professor Nicki Dowling, Deakin University

- Professor Bryan Rodgers, Australian National University

- Acting Director Rachel Henry, Welfare Quarantining and Gambling Branch, Department of Social Services

- Professor Mark Wooden, Melbourne Institute of Applied Economic and Social Research, University of Melbourne

- Doctor Diana Warren, Australian Institute of Family Studies

- Director Anne Hollonds, Australian Institute of Family Studies

- And all of the participants who took part in the HILDA Survey and made this report possible.

Disclaimer

This report uses unit record data from the Household, Income and Labour Dynamics in Australia (HILDA) Survey. The HILDA Project was initiated and is funded by the Australian Government Department of Social Services (DSS) and is managed by the Melbourne Institute of Applied Economic and Social Research (Melbourne Institute). The findings and views reported in this paper, however, are those of the authors and should not be attributed to either DSS or the Melbourne Institute. As well, the views expressed may not reflect those of the Australian Institute of Family Studies or the Australian Government.

Cover photo: © iStockphoto/>welcomia

Please note content from the problemgambling.gov.au website can now be found here.

Gambling Reforms

Digital technologies are rapidly changing Australia’s gambling industry.

The 2015 Review of Illegal Offshore Wagering (the Review) noted that online wagering is the fastest growing gambling segment, with over $1.4 billion gambled online each year. Digital technology is also enabling operators to reach our phones, our televisions, our home computers at any time of the day or night.

The Review also noted that Australians are losing between $64 million and $400 million every year betting in illegal offshore sites, and this means tax revenue is also lost. In the online world, the proportion of problem gambling is three times higher than in other forms of gambling*.

* Hing, N., Gainsbury, S., Blaszczynski, A., Wood, R., Lubman, D., & Russell, A. (2014). Interactive gambling. Melbourne: Gambling Research Australia

The Government is delivering on its commitments outlined in the Response to the 2015 Review of Illegal Offshore Wagering with stronger consumer protection as the centrepiece of these reforms.

Government’s Response to Illegal Offshore Wagering

On 28 April 2016, the Government announced its response to the recommendations of the Review, supporting 18 of the Review’s 19 recommendations. This commitment included a three-staged approach:

- The establishment of a National Consumer Protection Framework (National Framework) for online wagering, was announced on 30 November 2018.

- Amending the law to make it clear that it is illegal for unlicensed overseas gambling companies to offer gambling products to Australians. The Australian Communications and Media Authority is empowered to have stronger enforcement mechanisms, enacted in the Interactive Gambling Amendment Act 2017.

- Investigating the feasibility of other disruptions measures to curb illegal offshore gambling activity. The Government is implementing a website blocking scheme to protect Australians from illegal offshore gambling websites, as announced by the Minister for Communications, Cyber Safety and the Arts on 11 November 2019. The Australian Communications and Media Authority will use its powers to work in cooperation with Australian internet service providers to block illegal offshore gambling websites which are prohibited services under the Interactive Gambling Act 2001.

Latest News

‘Better Choices’ – Enhancing informed decision-making for online wagering consumers

The Behavioural Economics Team of the Australian Government (BETA) in the Department of the Prime Minister and Cabinet has released their findings from a randomised trial to determine the effect of activity statement features, to help consumers make informed decisions about their online wagering.

The aim of the trial was to design activity statement prototypes and test the effect of those activity statements on gambling behaviours in a simulated online betting environment.

BETA’s report, Better Choices – Enhancing informed decision-making for online wagering consumers, provides recommendations of activity statement prototypes including design and content features which are most likely to influence and empower consumers to make informed decisions about their online wagering activity.

The Commonwealth and state and territory governments are currently considering the findings of this report which are expected to inform the implementation of the ‘activity statements’ measure of the National Consumer Protection Framework for online wagering.

The full report is available at https://behaviouraleconomics.pmc.gov.au/projects/applying-behavioural-insights-online-wagering.

National Self-Exclusion Register legislation

On 12 December 2019, legislation providing for the National Self-Exclusion Register (Register) for online wagering received Royal Assent. This included the Interactive Gambling Amendment (National Self‑exclusion Register) Act 2019 and the National Self‑exclusion Register (Cost Recovery Levy) Act 2019.

The Register will allow consumers to exclude themselves from all interactive wagering services in Australia, quickly and easily, through a single process. This will meet a critical gap in consumer protection for Australians who participate in online wagering. The Register is a key measure under the National Consumer Protection Framework for online wagering.

The legislation allows the Australian Communications and Media Authority (ACMA) to procure an independent third party technology provider to supply, operate and maintain the Register. Additionally, the legislation will give the ACMA the necessary powers to regulate and enforce industry compliance in how it interacts with and funds the Register.

National Consumer Protection Framework for online wagering – Baseline Study Final Report.

On 24 November 2019, the Minister for Families and Social Services, Senator Anne Ruston released the final report of the National Consumer Protection Framework for online wagering (National Framework) baseline study.

The aim of the study was to establish base levels of online wagering involvement, the prevalence of risky gambling behaviour, and levels of online wagering consumer harm, ahead of the full implementation of the National Framework. The baseline study sets a benchmark to inform future evaluation activities to determine the effectiveness of the National Framework.

Undertaken by the Australian Institute of Family Studies the independent study involved an online consumer survey with over 5,000 people who wager online, a review of online wagering service providers’ and gambling regulators’ websites, and interviews with online wagering service providers and regulators.

Over half of the survey participants (52 per cent) were classified as being at risk-of or already experiencing gambling-related harm. This confirms the actions of all Australian Governments to implement the National Framework, and to ensure that it keeps pace with best practice consumer protection and changes in technology over time.

The Report includes recommendations for Government on the implementation of the National Framework and for the future evaluation phases of the National Framework.

Customer Verification

On 26 February 2019, new rules came into force that significantly reduce the customer verification period for new online wagering consumers from 90 days to a maximum of 14 days. This is the first measure delivered under the National Framework, since its announcement late 2018. The measure will be reviewed in 12 months with the intention of further reducing the verification period to 72 hours.

National Framework announcement

On 30 November 2018, the Commonwealth made a public announcement of the joint National Framework. This has been developed in close consultation with the state and territory governments and key stakeholders over two years.

The National Framework provides – for the first time – strong, nationally consistent protections for consumers of Australian interactive wagering providers.

Restrictions on gambling advertising

On 6 May 2017, former Senator the Hon Mitch Fifield, Minister for Communications and the Arts, announced the Broadcast and Content Reform Package. The package includes further restrictions on gambling advertising in live sporting events across all platforms to reduce the exposure of children to gambling.

The Australian Communications and Media Authority has also implemented the restrictions for online platforms. These new rules came into effect on 28 September 2018 and mark the first time ‘broadcast like’ restrictions have been applied to online content services in Australia, providing consistency across broadcast, subscription and online.

On 30 March 2018, the gambling advertising restrictions commenced following the registration of revised broadcast industry codes of practice by the Australian Communications and Media Authority.

Betting restrictions and online wagering in Australia - A review of current knowledge

The Betting restrictions and online wagering in Australia – A review of current knowledge is a report prepared by the Australian Gambling Research Centre (AGRC), Australian Institute of Family Studies, and commissioned by the Department of Social Services.

In September 2015, the Review of Illegal Offshore Wagering recommended that further research be undertaken on the impact of betting restrictions imposed by Australian licensed bookmakers on illegal offshore wagering and the identification of options to improve the situation.

In responding to Recommendation 15 of the Review, the Commonwealth Government commissioned the AGRC to investigate the current extent of betting restrictions and the impact of these restrictions in driving consumers to illegal offshore wagering operators.

The AGRC’s report, Betting restrictions and online wagering in Australia – A Review of current knowledge, provides a range of options for consideration, noting its interaction with other reform areas and the need for further research. The Commonwealth and state and territory governments are currently considering the findings of this report.

Gambling Measures Act 2012

Australia Problem Gambling Statistics Since

The Gambling Measures Act 2012 took effect on 31 March 2014 and outlines the Commonwealth’s commitment to consult on the development of venue based voluntary pre-commitment in realistic timeframes.

Australia Problem Gambling Statistics Articles

Last updated: